Planned giving often enables people to make a more substantial gift than they ever thought possible, enabling diverse options for dedications and commemorations and creating a legacy of help and caring in Israel for generations to come.

To help you achieve your philanthropic goals for Yad Sarah while providing for your financial needs, our planned giving program offers a wide range of giving options. All gifts carry membership in Jacob’s Circle, the legacy honor society of Friends of Yad Sarah.

Questions about Planned Giving?

Contact Adele Goldberg, Executive Director

+1-212-223-7758

Click on any of the seven options for Planned Giving below to get more information about that option.

Including Yad Sarah In My Will Or Trust

Benefits Of Including Friends Of Yad Sarah In Your Will Or Living Trust:

- Possible estate tax deduction

- Retain control of your assets while you can still use them

- Support of Yad Sarah from generation to generation

Remembering Friends of Yad Sarah in your will or trust can be easily accomplished with the designation of a specific dollar amount or other property. You may also designate Friends of Yad Sarah to receive a specified percentage of your estate assets.

The Following Is Some Sample Language That You May Use To Remember Yad Sarah:

Bequest Of Cash Or Property

I hereby give, devise, and bequeath to Friends of Yad Sarah, Inc., a tax-exempt not-for-profit corporation, having its principal offices at 445 Park Avenue, Suite 1702, New York, NY 10022, the sum of $_______(or insert detailed description of property) to be used for its general purposes.

Residuary Bequest

I hereby give, devise, and bequeath to Friends of Yad Sarah, Inc., a nonprofit corporation, having its principal offices at 445 Park Avenue, Suite 1702, New York, NY 10022, all (or ___%), of the rest, residue or remainder of the property owned by me at my death, real and personal and wherever situate, to be used for its general purposes.

Specific Bequest Of Personal Or Real Property

I hereby give, devise, and bequeath to Friends of Yad Sarah, Inc., a nonprofit corporation, having its principal offices at 445 Park Avenue, Suite 1702, New York, NY 10022, (insert detailed description of property) __________________________ to be used for its general charitable purposes.

For a confidential conversation regarding planned giving or to make a gift, please call Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

Charitable Gift Annuities: Guaranteed Lifetime Income

A Charitable Gift Annuity from Friends of Yad Sarah is an ideal way to accomplish your personal financial goals of maintaining or increasing your income stream and supporting the mission of Yad Sarah.

What are the benefits?

- Lifetime guaranteed income at attractive, fixed rates

- Improve the income of someone 60 years and older – perhaps you or a loved one

- Eligibility for a charitable income tax deduction for a portion of the gift

- Reduction and deferral of capital gains taxes liability if appreciated securities are used

- Part of your annuity payments may be tax-free for a number of years

- Support of Friends of Yad Sarah

- Reduction of assets in your estate

How does it work?

You make a one-time donation of at least $10,000 in cash or appreciated securities to Friends of Yad Sarah. In return for this gift, Friends of Yad Sarah pays one or two individuals of your choosing an annuity each year for life. You can choose to take payments immediately if you are 65 years or over or defer until a later age.

You are eligible for an immediate income tax deduction for the part of your contribution that is considered a charitable gift. The annuity payments received may be partially tax-free during the annuitant’s life expectancy. And you can reduce and defer capital gains taxes with donations of appreciated securities.

At the end of the lifetime of the annuitant(s), Friends of Yad Sarah benefits by retaining funds remaining from your initial donation.

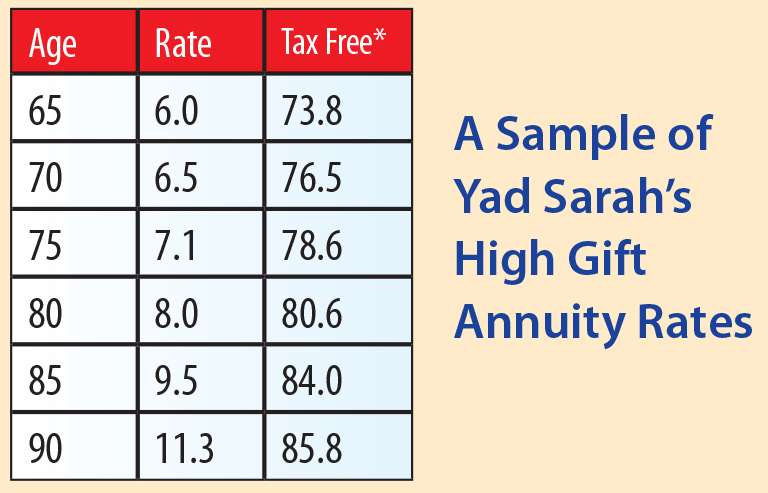

What is my annual annuity rate?

** The tax-free portion is calculated for the month the gift annuity is established.

For a confidential, detailed explanation and complimentary illustration of how Friends of Yad Sarah Charitable Gift Annuities can work for you, please contact Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

How do I apply?

Deferred Gift Annuities: Guarantee Future Income For Retirement

Benefits:

- Plan for and maximize retirement income

- Receive immediate income tax charitable deduction

- Remove assets from your estate

- Insure the future of vital caregiving support services in Israel through Yad Sarah

As you think about supplementing your existing sources of retirement income, and if you are 55 years or over, you might want to consider a Friends of Yad Sarah deferred annuity. This gift plan is particularly attractive to self-employed individuals on whom the IRS places a cap on contributions to retirement plans but who have excess income that could be used to provide a future stream when earnings decrease.

With a Friends of Yad Sarah Deferred Gift Annuity, you would make a current gift but defer payments to a future date of your choosing, generally at retirement age. The rate and amount of the annuity payment will be presented at the time the gift is made so you can accurately plan for your cash needs. Also, in addition to the good feeling that giving to Friends of Yad Sarah brings about, you will receive a current income tax deduction for a portion of the gift. A deferred gift annuity may be funded with cash or appreciated assets.

For a confidential personal benefits profile and determination of your deferred annuity rate, please contact Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

To Apply:

Can my Retirement Plan Help Yad Sarah?

Did you know that you can support Yad Sarah’s vital caregiving programs and services by naming Friends of Yad Sarah as the partial or sole beneficiary of your IRA, 401(K), 403(B) or other retirement assets?

What are the benefits?

- Reducing estate taxes upon death

- Easily executed with a beneficiary designation form

- Supporting Yad Sarah in Israel for generations to come

Why use retirement assets to make a gift?

Since retirement plan assets may be subject to both income and estate taxes if left to heirs, estate planners often recommend that you designate all or a portion of the assets to a charitable organization. By leaving assets to Friends of Yad Sarah, you can distribute other assets to your heirs, which may lower the tax burden.

How can I name Friends of Yad Sarah as a beneficiary?

You can request a “change of beneficiary” form from your retirement plan administrator and name Friends of Yad Sarah as sole or partial beneficiary, or you can name the organization as a contingent beneficiary in case you are predeceased by your immediate beneficiary.

On the form, list us as:

Friends of Yad Sarah, Inc.

445 Park Avenue, Suite 1702, New York, NY 10022

Tax ID # 13-3106175

For a confidential conversation regarding planned giving or to make a gift, please call Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

I Have Excess Life Insurance

Did you know that you can support Yad Sarah’s extensive volunteer network of helping services in Israel by naming Friends of Yad Sarah as the partial or sole beneficiary of your life insurance policy? By designating Friends of Yad Sarah as a beneficiary of an insurance policy, the proceeds will not be subject to estate taxes upon your death. Also, if you transfer ownership of the policy to Friends of Yad Sarah during your lifetime, you may qualify for an income tax charitable deduction and you may deduct the cost of future premium payments.

Benefits:

- Be eligible for an immediate income tax charitable deduction

- Create a sizeable gift for Yad Sarah with minimal out of pocket costs

- Insure the future of Yad Sarah’s programs and services in Israel

How can I name Friends of Yad Sarah as a beneficiary?

If the policy already exists, you may request a “change of beneficiary” form from the insurance company. You can name Friends of Yad Sarah as sole or partial beneficiary or you can name the organization as a contingent beneficiary in case you are predeceased by your primary beneficiary. On the form, list us as:

Friends of Yad Sarah, Inc.

445 Park Avenue, Suite 1702, New York, NY 10022

Tax ID # 13-3106175

For a confidential conversation regarding planned giving or to make a gift, please call Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

I want to avoid Capital Gains Tax and Receive Income for Life

Charitable trusts blend security for your own or your family’s financial future with your charitable intent for Yad Sarah.

A charitable remainder trust will allow you to provide for income to one or more beneficiaries for a term of years or for their lifetimes. At the end of the term of the trust the remainder will pass to Friends of Yad Sarah to enable the Yad Sarah organization in Israel to carry on its vital mission. A charitable remainder trust also provides you with favorable tax benefits. Charitable remainder trusts can be designed to provide a fixed annuity amount to your income beneficiaries or a fluctuating amount annually based on the growth of the assets. You may use cash or appreciated assets to fund a charitable remainder trust.

Benefits of a Charitable Remainder Trust:

- Create income stream for yourself or beneficiaries of your choosing

- Receive immediate income tax charitable deduction

- Remove assets from your estate

- Possibly eliminate capital gains if funding the trust with appreciated assets

- Insure the future of Yad Sarah’s volunteer-staffed home and health care support services in Israel

A charitable lead trust is a gift option that provides a stream of income to Friends of Yad Sarah for the term of the trust. At the end of the term the remainder value is usually paid to the donor’s heirs at appreciated values with favorable tax implications.

A gift of appreciated property to a charitable remainder trust pays income to you and your heirs. You can create income streams from appreciated or dormant assets and avoid capital gain taxation or burdensome maintenance costs.

Benefits of a Charitable Lead Trust:

- Create income stream for Friends of Yad Sarah and support the work of the Yad Sarah organization in Israel

- Receive immediate gift tax charitable deduction

- Pass assets on to your heirs in a tax advantaged way

All trust documents should be drawn by your own attorney and under the advice of your financial advisors. However, for a personal evaluation of how a trust may be a beneficial way for you to make a gift Yad Sarah, please contact Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

Making a gift of Appreciated Property/Stocks

You can support the vital work of Yad Sarah by making a gift of appreciated stock.

You can transfer ownership of your home to Friends of Yad Sarah and continue to use it as you always have. You can retain use of your home during your lifetime and receive major tax benefits at the same time.

Advantages include:

- Avoiding federal and state tax on capital gains;

- Receiving an income tax deduction for the full market value of your gift if you itemize deductions on your tax return and have held the assets for at least one year; and

- Making a larger gift at a lower original cost to you.

Please consult your financial planner or tax advisor to determine how these potential tax advantages apply to your specific situation.

How to make a stock donation to Friends of Yad Sarah

For securities held by a brokerage firm, instruct your broker to make an electronic transfer to:

DTC #0188

Account # 868513204

TD Ameritrade

Information we need:

Name of securities;

Number of shares you are transferring;

Brokerage house / accounting firm and contact name; and

Your address, phone number and e-mail address.

Please let us know about your gift. Privacy laws discourage brokerage firms from releasing the names of clients. If you forget to inform us that your donation is being transferred via stock, we may have trouble crediting and thanking you for your generous gift.

For more information or for instructions on donating other types of securities (i.e., stocks held in certificate form, mutual funds, or a planned gift), please call Adele Goldberg, Executive Director, at 212-223-7758, 866-YAD-SARAH or e-mail at

From all of us at Friends of Yad Sarah, thank you!

Friends of Yad Sarah, Inc. is a 501(c)(3) nonprofit organization, ID #13-3106175. Gifts are tax-deductible to the extent allowable by law.